Revolutionizing Accounting: Leveraging AI for Automation

When I first delved into the world of artificial intelligence, its potential to transform industries was abundantly clear. However, it’s in finance and accounting where AI’s impact is profoundly revolutionary. The advent of accounting automation with AI is one of those game-changing innovations that not only streamlines processes but also offers a strategic advantage to businesses of all sizes.

Why AI in Accounting is a Game Changer

Automation isn’t new to the accounting industry. Still, the infusion of AI has elevated it to a level where the benefits are tangible and immediate. Imagine transforming the tedious process of bookkeeping into an efficient, error-free journey. That’s precisely what AI-powered bookkeeping software enables.

- Error Reduction: Human errors in data entry and calculation are significant pain points in traditional accounting. AI drastically reduces these errors, ensuring that businesses can trust their numbers.

- Enhanced Compliance: Keeping up with ever-evolving regulatory requirements is daunting. AI’s capability to automate workflows ensures compliance with industry standards like GAAP, IFRS, and others.

- Increased Productivity: By automating routine tasks, accountants can focus on higher-value activities, such as financial analysis and strategy development, radically changing their role from reactive to proactive.

Challenges on the Road to AI Implementation

As with any innovative technology, incorporating AI-powered bookkeeping software into accounting systems is not without its challenges. Here are some key concerns companies must navigate:

- Data Privacy: Handling sensitive financial data requires robust security protocols, and AI systems handling this data must be rigorously safeguarded against breaches.

- Integration with Existing Systems: Many businesses operate on legacy systems. Integrating AI solutions requires careful planning and execution to ensure a seamless transition without disrupting existing workflows.

- Cost of Implementation: While AI adoption promises significant long-term savings, the initial investment can be high, which might deter smaller companies from jumping on board.

Strategic Steps for Successful AI Adoption in Accounting

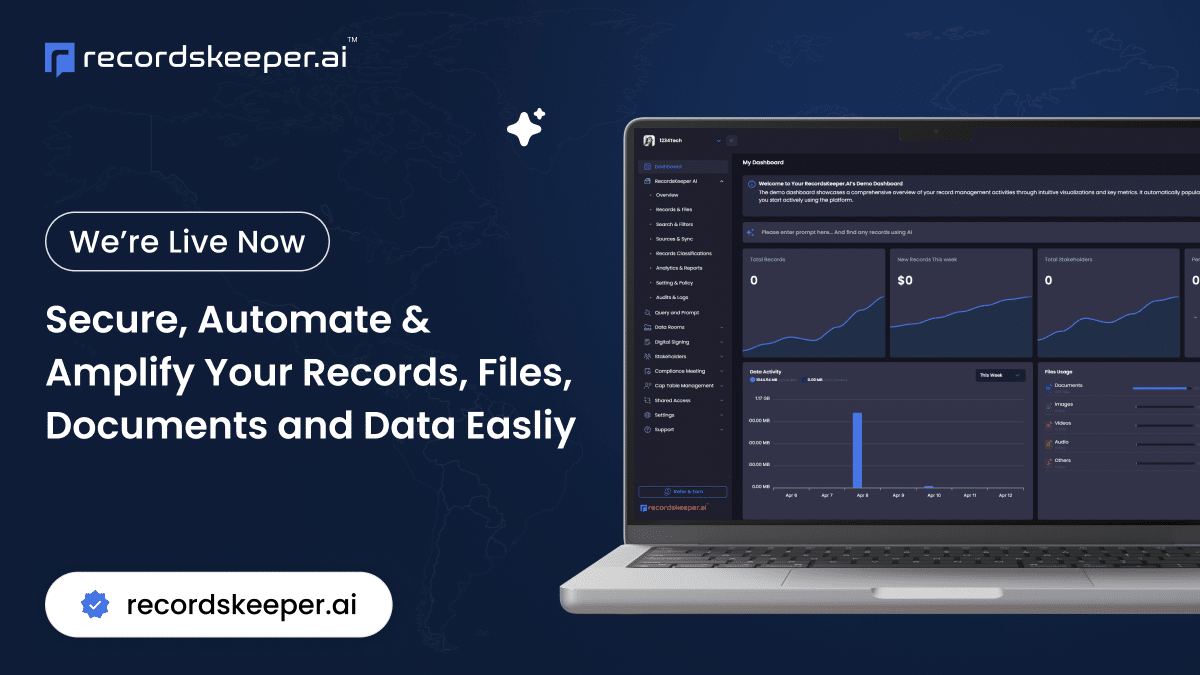

From my experience at RecordsKeeper.AI, the excitement of embracing new technology must be balanced with strategic planning. Here’s a structured approach to integrating AI in accounting:

1. Evaluate Your Needs: Understand the specific pain points and objectives of your business. Are you looking to enhance accuracy, improve compliance, or increase productivity?

2. Select the Right Tools: Not all AI tools are created equal. Evaluate solutions based on your needs, scalability, and technological compatibility with your current systems.

3. Pilot Programs: Run pilot programs to gauge effectiveness and tweak systems accordingly before a full-scale rollout.

4. Training & Involvement: Ensure that accounting teams are well-trained and involved in the AI adoption process. This fosters an environment of collaboration and minimizes resistance to change.

5. Continuous Monitoring and Improvement: Post-implementation, continuously monitor AI systems to ensure they achieve desired outcomes and adapt to evolving needs and regulatory standards.

The Future of Accounting Automation

Looking ahead, the landscape of accounting will be characterized by AI-powered bookkeeping software that doesn’t just stop at automating mundane tasks but also plays an integral role in strategic financial planning. AI’s predictive capabilities can soon assist in everything from forecasting revenues to detecting financial anomalies with unprecedented precision.

For those overseeing legal, finance, and compliance roles, this technology heralds a profound shift. Embracing it means moving beyond traditional record-keeping towards a more dynamic and strategic approach. It means transforming from custodians of financial data to architects of business strategy.

In closing, the benefits of accounting automation with AI clearly outweigh the challenges. It’s an exciting era for accounting professionals willing to leverage technology to redefine their roles, and I’m thrilled to witness this transformation from the frontline. For regular insights into emerging tech and its impact on accounting and beyond, stay connected with me on this journey of innovation.