Transforming Sole Trader Accounting with AI-Powered Solutions

Managing finances as a sole trader comes with its own set of unique challenges, especially when it comes to bookkeeping and accounting. In today’s fast-paced world, juggling client projects while maintaining accurate records can seem daunting. That’s where AI-powered accounting software comes in, reshaping how freelancers and consultants manage their financial responsibilities.

The Growing Need for Efficient Bookkeeping

For many freelancers and self-employed individuals, the task of bookkeeping often gets pushed to the back burner. However, maintaining a clear, up-to-date record of your financial affairs is crucial—not just for tax filing purposes, but for understanding your business performance as well. AI technology offers a streamlined solution to handle these tasks efficiently, freeing up valuable time for what matters most: growing your business.

Why Choose AI-Powered Accounting Software?

- Automation of Mundane Tasks: One of AI’s greatest strengths is its ability to automate repetitive tasks. Whether it’s categorizing transactions or reconciling statements, AI-powered software leaves less room for human error and ensures accuracy.

- Smart Data Insights: AI doesn’t just help with day-to-day functions; it offers data-driven insights, enabling you to make informed decisions. By providing analytical reports, you can understand cash flow trends and potential growth areas.

- Time Efficiency: With automation taking care of number-crunching activities, you can dedicate more time to client work, ultimately boosting your business productivity.

Popular AI Accounting Tools for Sole Traders

With a variety of options available, selecting the right accounting software for sole traders can significantly impact how you manage your financials. Below are some leading AI-powered platforms helping freelancers and consultants streamline their business:

1. Xero

Xero is an intuitive platform that is a favoured choice among sole traders. Known for its robust capabilities, Xero leverages AI to provide real-time financial dashboards and personalized reports. With a user-friendly interface, it’s perfect for those who might not be tech-savvy yet need efficient self-employed bookkeeping.

2. QuickBooks Self-Employed

QuickBooks has long been celebrated in the accounting industry, and their self-employed version specifically caters to freelancers. Integrated with AI, it tracks mileage, separates business from personal expenses, and organizes tax deductions, making it a comprehensive tool for managing finances.

3. FreshBooks

FreshBooks excels in simplifying invoicing and time-tracking tasks. Equipped with AI, it offers automation options for recurring billing and late payment reminders, along with enriching self-employed bookkeeping with effortless expense tracking.

How to Choose the Best Solution

When selecting the right AI-powered accounting software, consider aspects that align with your business needs:

- Features Required: Identify what functionalities are crucial for you. Do you need extensive reporting or simple invoicing?

- User Experience: Opt for software that feels intuitive. Ample customer support and tutorials can ease the learning curve.

- Integration Capability: Choose software that seamlessly integrates with your existing tools for added efficiency.

- Cost Consideration: Compare pricing plans but prioritize value over cost. Tools with better automation may reduce long-term expenses, despite a higher initial investment.

Conclusion

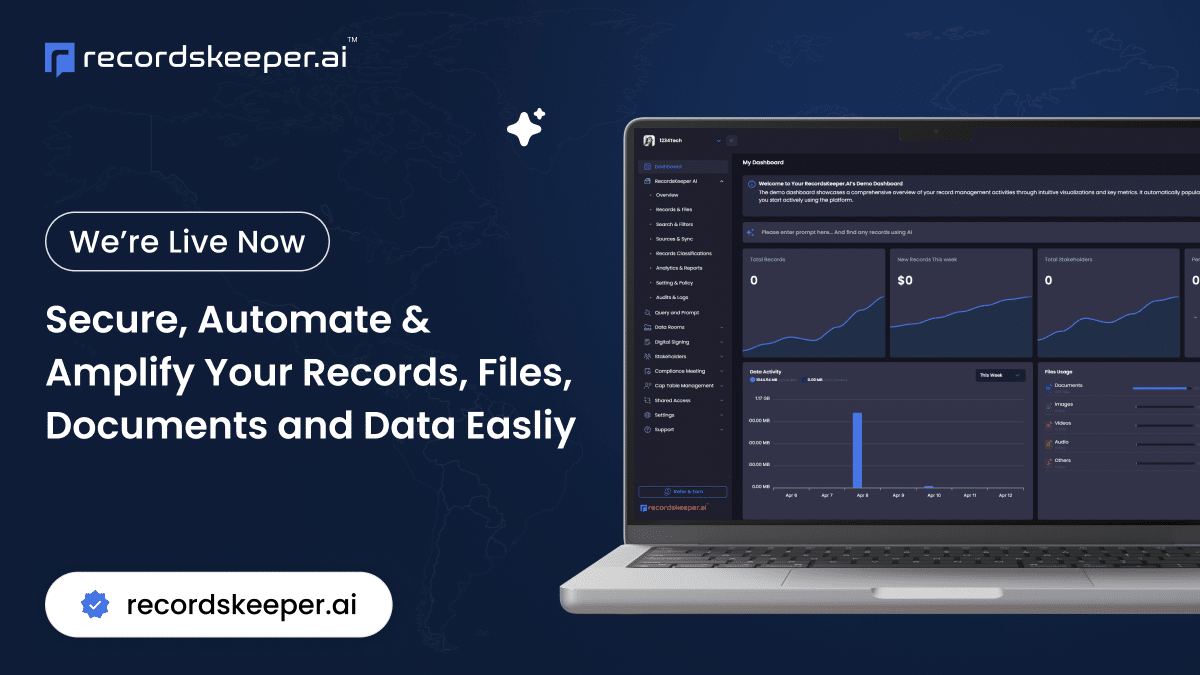

Navigating the world of accounting software for sole traders can seem overwhelming, but the integration of AI has made it substantially easier. By choosing a platform that fits specifically to your professional requirements, you not only automate menial tasks but empower yourself to focus fully on business growth. For further insight into maximizing efficiency with technology, follow my journey as I continue to explore innovative solutions that redefine record management and financial health for all.

Embrace the future of self-employment with AI—simplified, efficient, and powerful. Welcome to the next generation of record management with RecordsKeeper.AI.