As a freelancer or independent professional, the freedom to work on your own terms can be both exhilarating and daunting. One aspect that tends to tip the exhilaration into apprehension is managing your finances. Being your own boss means that bookkeeping becomes your responsibility, not someone else’s. This makes it critically important to know the best tools out there to make this aspect of work less taxing.

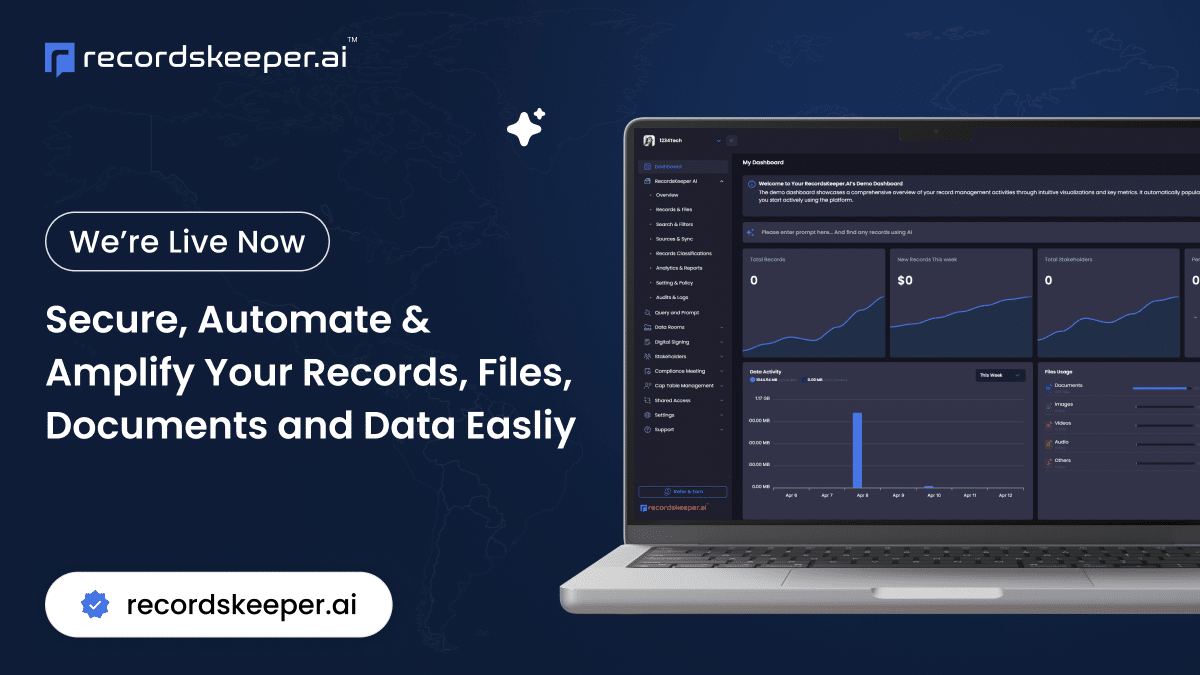

Enter the transformative world of AI-powered accounting software tailored specifically for freelancers. By harnessing the capabilities of artificial intelligence, these platforms can dramatically streamline your financial management like never before.

Challenges Facing Freelancers in Bookkeeping

Freelancers face unique challenges in managing their finances, distinct from the ones encountered by larger firms. Absence of a structured accounting department means that overlooking a vital bookkeeping task can result in cash flow problems or non-compliance with tax obligations.

Why AI-Powered Accounting Software?

The rise of AI in financial technology has opened up software solutions that address various pain points for freelancers. From automating tedious manual entries to generating insightful analytics, these tools offer a flexible and efficient way to keep financial records as a freelancer. The best accounting software for freelancers not only automate bookkeeping tasks but can also predict future financial trends, thereby supporting strategic decision-making.

Key Benefits

Exploring the Top AI-Powered Accounting Solutions for Freelancers

QuickBooks Self-Employed

QuickBooks Self-Employed is renowned as one of the best accounting software for freelancers. It excels in categorizing expenses, tracking mileage, and generating tax estimates to keep you prepared throughout the year. The AI features include automated expense categorization and sophisticated invoicing options to match your unique billing preferences.

FreshBooks

FreshBooks offers a user-friendly interface enriched with features like time tracking, easy invoicing, and client notification tools. AI-enabled functions help streamline billing processes and secure prompt client payments. It is an ideal choice for self-employed bookkeeping, particularly in creative fields like design and writing.

Xero

Xero stands out with its robust network integration and comprehensive reporting capabilities. Integrating AI, it creates smarter financial insights that drive successful business decisions. With automatic bank feeds and secure invoice processing, it is targeted at freelancers who appreciate a data-driven approach.

Wave Accounting

Targeted for freelancers on a tight budget, Wave Accounting offers a freemium package with multiple features like receipt scanning, bank connections, and income/expense categorization. AI algorithms enhance its effectiveness by processing tons of real-time financial data.

How to Choose the Right Software

When deciding on the ideal tool, consider factors such as ease of use, customer support, hardware compatibility, and pricing. Prioritize fit based on your industry demands and scale of freelancing activities. The best accounting software for freelancers should fuel efficiency rather than detract from it.

It’s equally important to evaluate if the chosen tool possesses the most essential features that a self-employed professional requires, like invoice management, real-time analytics, and seamless integration with banks and third-party apps.

Conclusion

The financial landscape for freelancers is rapidly changing, driven by advances in AI and cloud technology. With platforms like QuickBooks, FreshBooks, Wave, and Xero leading the way, worry and inefficiency are slowly becoming relics of the past. Embracing an AI-powered self-employed bookkeeping tool ensures you’re not just meeting current financial obligations but also preparing for a prosperous future.

Feel free to explore these offerings further to see which one aligns best with your unique freelancing needs. It’s time to modernize financial management and take charge of your freelance career effectively.

Follow my journey and more insights on tech-powered business transformation by staying tuned to our latest posts. Let’s harness technology to elevate the freelance experience.