When it comes to insurance, efficiency is crucial. The landscape is evolving rapidly, and to keep pace, the industry must embrace new technologies. I’ve always believed in the power of cutting-edge solutions like artificial intelligence (AI) to transform conventional processes into streamlined operations. In an industry as traditionally rigid as insurance, the integration of AI-powered insurance tech, especially insurance document automation, is starting to revolutionize how we handle claims processing.

Addressing the Traditional Bottlenecks in Claims Processing

For any insurance company, dealing with claims can be a complex and time-consuming activity. The traditional claims process involves a lot of paperwork, manual verification, and assessment, which can lead to unnecessary delays. It’s not just a matter of inconvenience; these delays can affect customer satisfaction, and ultimately, the company’s bottom line. Insurance document automation powered by AI has the ability to untangle these bottlenecks by leveraging technology to simplify and expedite the entire process.

AI: The Architect of Modern Insurance Tech

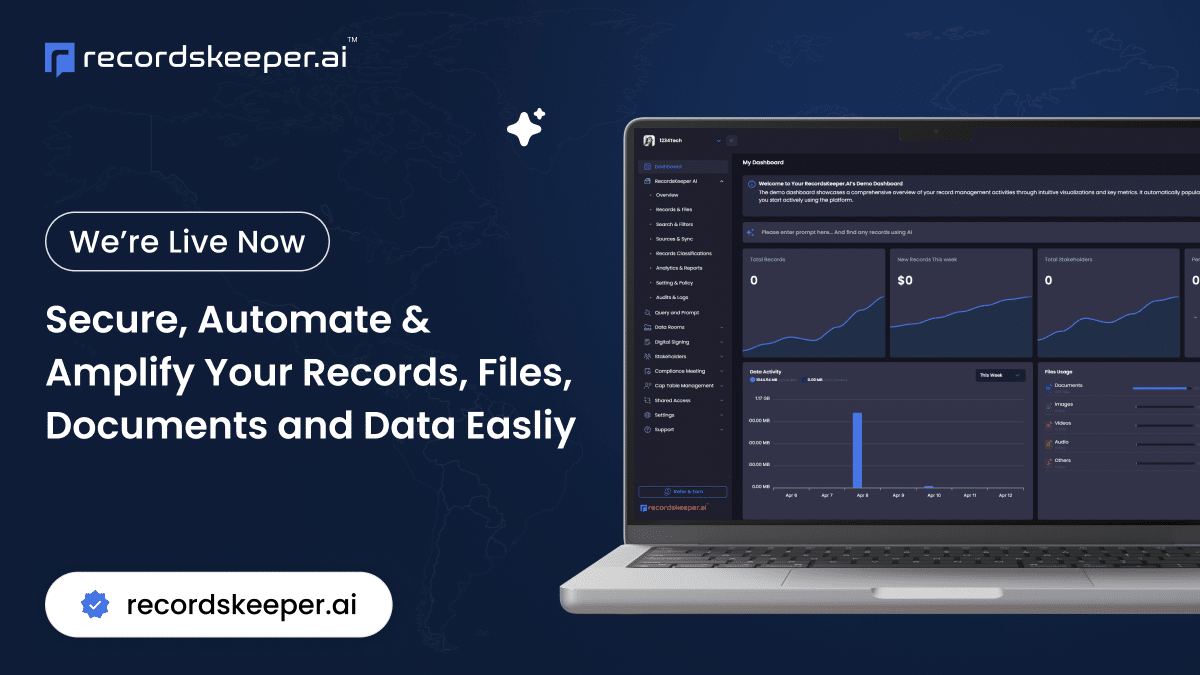

Traditional models are often plagued by human error and inefficiency. This is where AI-powered insurance tech comes into play. AI algorithms capable of learning and adapting can process data at an unparalleled speed and accuracy. This technology can automatically categorize and digitize documents, making them instantly accessible for all parties involved. With this level of automation, insurers can focus more time on making strategic decisions rather than getting bogged down in administrative tasks.

Automating Documentation for Better Accuracy

Insurance document automation minimizes human intervention, which is often where errors creep in. By implementing AI, you can ensure that every document is indexed correctly, all information is accurately filled, and potential discrepancies are flagged instantly. This not only accelerates the claims process but also significantly reduces the risk of fraud through meticulous data monitoring.

A Paradigm Shift in Customer Experience

Insurance companies leveraging AI are not just improving their internal efficiencies; they’re also revolutionizing the way they interact with customers. Faster claims processing means less waiting time and increased customer satisfaction. Imagine the convenience of having your claims processed in minutes, not days. This improved customer experience can lead to higher client retention rates, as people will trust a company that offers swift and accurate claims handling.

Enabling Cost Efficiency in the Insurance Sector

Aside from speed and accuracy, there is also the matter of cost. Manual processing of documents involves hefty labor costs, both in terms of human resources and materials. The transition to an AI-based system can drastically minimize these costs. With fewer errors, there are also fewer costly disputes or corrections needed further down the line. AI-powered solutions allow insurers to allocate their financial resources more effectively, creating better service offerings without escalating expenses.

The Compliance Conundrum

Insurance is heavily regulated, necessitating rigorous compliance processes. AI can effortlessly navigate this terrain by consistently monitoring and updating records to align with changing regulations. Audit logs and compliance-ready reports generated automatically by AI-driven systems ensure not only adherence but efficiency in regulatory practices.

Preparing for the Future

The integration of AI in insurance document automation is not merely a trend; it’s a necessity for those looking to stay relevant in an increasingly competitive industry. By making strategic use of AI, insurance companies can be ready to face future challenges, armed with a tool that allows them to remain responsive, reliable, and resilient.

Final Thoughts

In the ever-evolving world of insurance, standing still simply isn’t an option. By embracing AI-driven automation, we are not only improving existing processes but laying the groundwork for the future. I encourage fellow entrepreneurs and industry leaders to explore AI-powered solutions as a way to transform challenges into opportunities. Stay ahead in the game by adopting technology that streamlines operations and enhances customer satisfaction. If you’re intrigued by how AI and technology are redefining industries, follow me for more insights into the exciting world of tech innovation.