Transforming Small Business Accounting: Is QuickBooks the Right Fit for You?

In my journey as an entrepreneur, I’ve often wrestled with the decision of choosing the right tools to streamline operations and boost efficiency. One of the most frequently discussed tools in the financial realm is QuickBooks. For small businesses, effective accounting is the backbone of sustained growth, but is QuickBooks the right solution for your enterprise? In this article, I’ll explore this question and introduce the cutting-edge intersection of AI in financial software.

Understanding Your Business Needs

Every successful business journey begins with understanding specific needs and challenges. As a small business owner, the question “Do I need QuickBooks for my small business?” often depends on what tasks you need streamlined.

Assess these fundamental metrics and determine whether simplifying these areas with an intuitive interface can be advantageous to your business.

QuickBooks vs. Other Accounting Solutions

When it comes to accounting software, there are various options in the market, each with unique features. While QuickBooks is a popular choice, it’s essential to weigh it against other solutions.

It’s crucial to evaluate these aspects in the context of your business dynamics before making an investment.

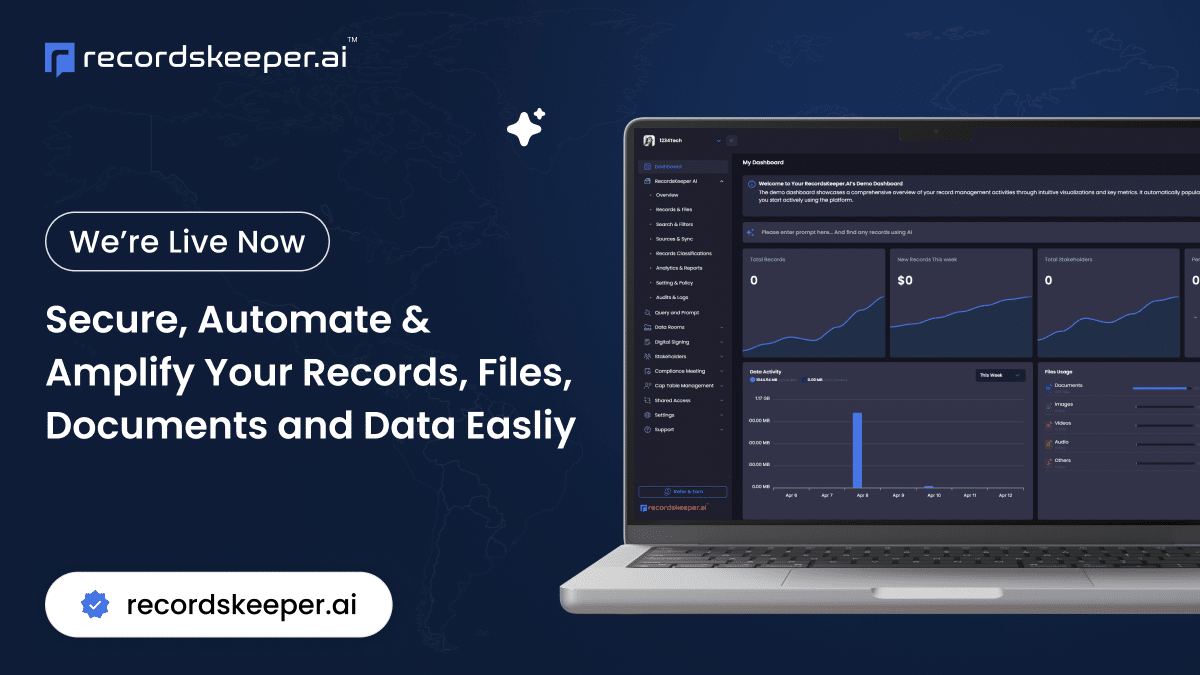

Leveraging AI in Financial Software

As our world becomes more intertwined with technology, incorporating AI in financial software has become a game-changer for small businesses. AI has the potential to revolutionize how financial transactions and data are handled.

How does AI come into play?

AI brings an evolutionary leap in optimizing accuracy and efficiency. If your enterprise is set on exploring new frontiers through technology, integrating AI into your strategy promises to redefine financial management.

The Final Verdict

Ultimately, the decision to adopt QuickBooks—or any accounting software—should align with your strategic objectives, size, and specific needs. It’s as much about purpose as it is about functionality. Whether you aim to consolidate existing processes or pave the way for technological advancement through AI in financial software, QuickBooks offers significant benefits.

Does this resonate with your small business perspective? I encourage you to evaluate the potential gains through trials or consultations. Remember, the right choice will lay a foundation that nurtures your business ambitions.

Stay updated as I further delve into the dynamic realm of finance technology and share more journeys of innovation. You’re always welcome to connect with me to explore how cutting-edge record management can be a considerable advantage for your venture.