Revolutionizing Small Business Accounting with AI

As an entrepreneur, one of the most critical choices I’ve made is finding the right accountant for my businesses. Small businesses, by their nature, require specialized attention to their financial landscapes — not only to maintain compliance but to strategically guide growth. Navigating this complex world requires the precision of a surgeon and the foresight of a fortune teller. That’s why leveraging modern technology, particularly AI in financial advisory, has been a game-changer.

Why Small Businesses Need Specialized Accountants

Small businesses often operate with tighter budgets and fewer personnel than large corporations, making each financial decision weighty. Here’s why specialized expertise matters:

- Personalized Attention: A knowledgeable accountant for small businesses can offer tailored advice that aligns with the unique business goals and industry context.

- Cost Efficiency: Experienced accountants can identify tax deductions and credits that a generic approach might overlook.

- Time Management: Outsourcing financial tasks allows business owners to focus on core activities while ensuring timely tax compliance and reporting.

The Role of AI in Modern Accountancy

Enter AI — a transformative force in financial services. It has moved from being a conceptual novelty to a vital tool in simplifying and optimizing accountancy tasks. Here’s how AI is revolutionizing the field:

1. Automating Routine Tasks

AI-powered solutions handle repetitive bookkeeping entries, reconcile bank statements, and manage invoice processing—tasks that traditionally ate up hours of valuable time. With smart automation, accountants can focus on strategic advisory roles, enriching their service offering.

2. Enhancing Data Accuracy

Mistakes in bookkeeping can lead to significant compliance and financial risks. AI algorithms, with their ability to process vast datasets with precision, drastically reduce errors, ensuring accuracy in financial reporting.

3. Real-Time Financial Insights

AI-driven analytics provide real-time insights by analyzing financial trends and patterns. This allows accountants to forecast cash flow more accurately, helping businesses make informed decisions swiftly.

4. Advanced Tax Compliance

Tax laws are dynamic and often complex. AI tools stay updated with the latest regulations, flagging potential compliance issues and offering strategies for tax optimization without stepping outside legal boundaries.

How to Choose the Right Accountant for Your Small Business

Deciding on the best fit is a process that involves careful consideration:

1. Evaluate Their Experience in Your Industry

An accountant with experience in your specific industry will understand the nuances of your business model and be proactive in offering solutions that adhere to sector-specific challenges.

2. Proficiency with AI Tools

Ensure your accountant is well-versed in employing AI tools. This can significantly enhance efficiency and accuracy in handling your accounts.

3. Strategic Advisory Skills

Beyond number-crunching, your accountant should be a strategic partner, capable of advising on long-term financial goals and business expansions.

Conclusion: Embrace the Future

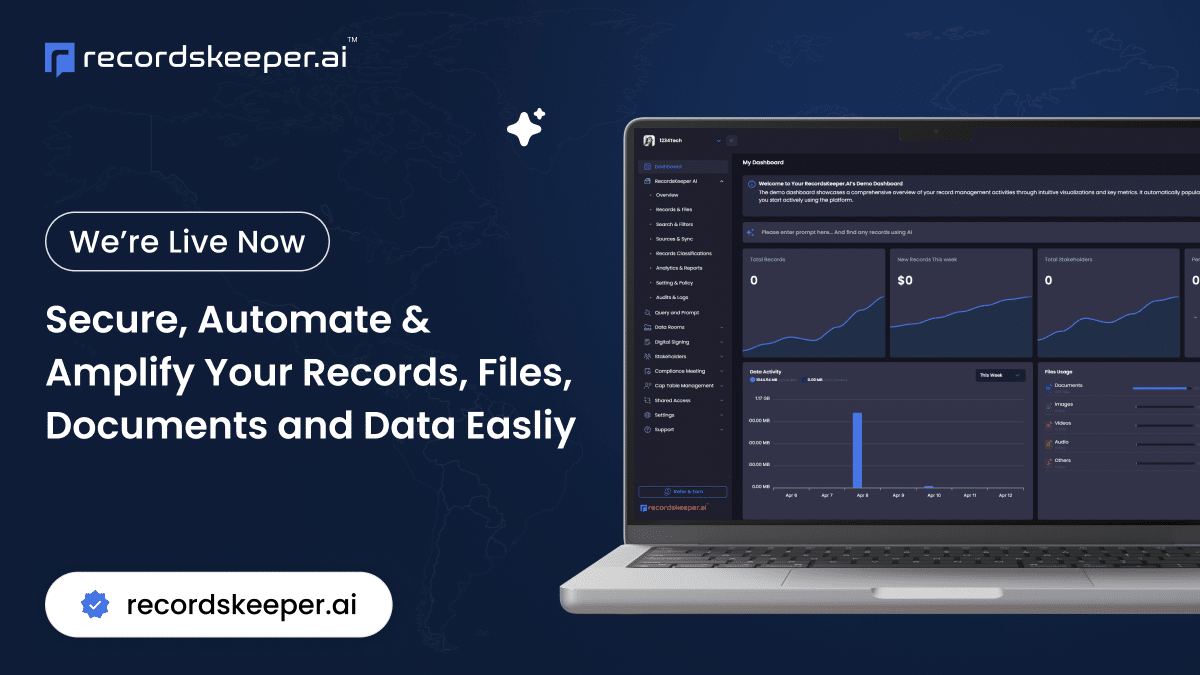

As technology continues to evolve, the intersection of AI and accountancy will only deepen. By integrating these innovations into small business accounting practices, companies are better equipped to navigate the financial intricacies that come their way. The goal isn’t just compliance or routine bookkeeping; it’s about leveraging insights for sustained growth and competitive advantage.

For every legal, finance, and compliance head responsible for managing records, embracing AI-driven accountancy tools is not merely a smart choice—it’s a necessity for future-ready businesses. By focusing on what really matters with an adept accountant by your side, powered by the precision of AI, you’re on a path not just to survive but to thrive. Stay tuned for more insights into how these cutting-edge technologies are reshaping industries across the board. Let’s embark on this progressive journey together.